By Melissa Conyears-Ervin · Published: November 17, 2025

In recent weeks, my team at the Chicago treasurer’s office and I worked tirelessly to craft our budget for City Council review. This work was conducted amid the backdrop of our federal government waging a campaign of terror against our residents and taxpayers.

I believe we have a responsibility to use every lawful tool at our disposal to push back on what they are doing. At the treasurer’s office, that tool is our investment portfolio. The dollars we invest can either quietly support that behavior or send a clear message that Chicago will not bankroll its own abuse.

Before my budget presentation on Wednesday, I informed City Council members that I would boycott the purchase of United States Treasury securities and seek their authority to grant me freedoms to modify the portfolio of the nearly $11 billion of Chicago taxpayer money the office manages.

This boycott and divestment plan is simple and targeted. First, we immediately stop making new, direct purchases of U.S. Treasury marketable securities. Second, with approval from the City Council, we will explore reducing our indirect exposure by adjusting our holdings in money market funds and other instruments that derive their value from Treasurys.

That’s it.

This is a temporary, lawful portfolio adjustment that meets our three core objectives as managers of taxpayer funds: safety, liquidity and competitive returns for the taxpayer.

The city of Chicago will not invest in a federal administration that is using the power of government to terrorize us. Federal agents in our neighborhoods pepper-spraying a 1-year-old, dragging a teacher out of a day care in front of toddlers and drawing guns on our citizens are what brought about this response.

What is happening is not normal, and pretending it is will not age well in the history books. Our constituents will remember who stood up when it mattered and who didn’t.

When I rolled out my plan, I was met with hysteria from a few members of the council and some members of the media. They sounded more concerned about aggravating Donald Trump than using every tool we have to stop his U.S. Immigration and Customs Enforcement agents from waging war on our citizens.

Others expressed reasonable concerns with the plan that we can address. I have managed more than $9 billion of our public funds on an annual basis over the past six years across two administrations. I am intimately familiar with our portfolio, my responsibility to taxpayers and the risks embedded in my decisions. I am eager to collaborate further and look forward to modernizing outdated restrictions that actually limit our ability to earn more for Chicagoans.

But let’s be clear: This is a safe move that poses no financial risk to the taxpayer, it will earn an appropriate return, it is consistent with our liquidity obligations and, most importantly, it is consistent with our values.

That’s why I was elected and what I’ve done for the past six years. We’ve outperformed previous treasurers, we’ve divested from fossil fuels, and we’ve still maintained competitive returns and strong liquidity.

Ald. Raymond Lopez, 15th, called this move “reckless,” and others reminded me that Treasurys are “the most liquid and secure debt instrument in the history of the world.” I’m well aware, but any financial expert also knows that Treasurys are not the only high-quality, secure and liquid option available.

We can and do invest in agency securities. We can and do invest in investment-grade corporate bonds. We can and do invest in municipal bonds, mortgage-backed securities and fully secured cash vehicles. These instruments are all permitted under our existing policy, widely used by large institutional investors and compatible with our fiduciary duty to keep the city’s money safe and accessible.

This is not gambling with taxpayer dollars. It’s a choice not to write a blank check to an administration that is violating our rights.

It’s also wholly transparent. The municipal code gives me authority to adopt and amend our investment policy, including the ability to direct no new purchases of Treasurys, but the next phase of this plan requires council approval. I’ve already begun those conversations, and changes will be reported publicly, fully consistent with our collateral and liquidity requirements, and voted on after an open debate.

Some suggest that by taking this stand, I’m somehow turning my back on America or violating my oath. Let me tell you what I believe as a Black woman, as a daughter of Englewood and Austin, and as a proud American: The most patriotic thing you can do in this country is to use your voice, your vote and, yes, your public office to protest your government when it is wrong.

The idea that we must silently underwrite policies we believe are unconstitutional and immoral is what’s un-American.

Finally, to those that question the impact of this decision, I say every major act of divestment, from apartheid South Africa to fossil fuels, has started with “just” one institution. I believe Chicago is in a unique position to lead.

To every resident, whether you agree with this plan or not, I want you to know I am not making this decision lightly. I know what it means to be responsible for billions of dollars. I know what it means when payroll has to be met, when pension checks have to clear, when a city has to ride out a crisis. My first obligation is to keep your money safe and accessible.

But I will not separate that obligation from our moral responsibility to ensure that our own dollars are not weaponized against us.

Content courtesy of The Chicago Tribune

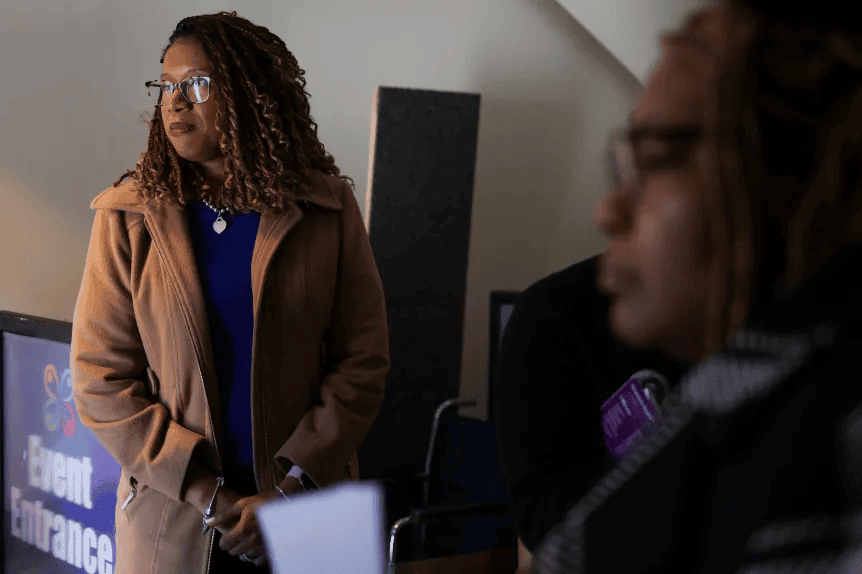

Melissa Conyears-Ervin is the Chicago city treasurer and running for Illinois’ 7th Congressional District.